amazon flex taxes uk

Select Sign in with Amazon. Ill be over my yearly personal allowance from my main job so Id have to submit a tax return myself as Amazon doesnt.

How To Get More Amazon Flex Blocks 6 Best Tips For Drivers

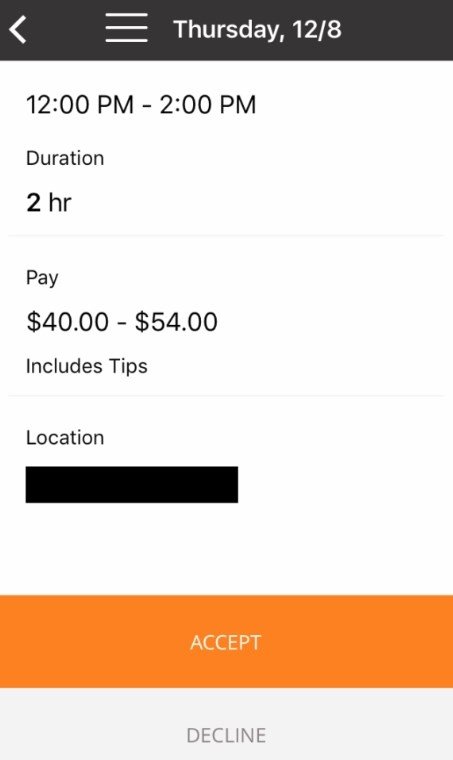

With Amazon Flex you work only when you want to.

. Driving for Amazon flex can be a good way to earn supplemental income. Class 2 National Insurance this. The app does show house names and numbers which are a big help but still needs improvement.

The general rule of thumb is to put away 30-35 of your Adjusted Gross Income income reduced by tax write-offs for taxes. Discover short videos related to amazon flex tax return uk on TikTok. Amazon Flex will not withhold income tax or file my taxes for me.

Finding flats in particular can be frustrating. Adjust your work not your life. Amazon Basics Enhanced Flex Grip Work Gloves - Blue XXL.

I have recently started doing part time work with Amazon Flex this basically for tax purposes makes me a self employed contractor. My question is as follows in relation to Amazon Flex and claiming mileage. We know how valuable your time is.

Income Tax depending on how much you earn youll be taxed at 20 40 or 45. Tap Forgot password and follow the instructions to receive assistance. I already work a normal 9-5 job and pay tax and NI through PAYE.

UK drivers and doing your taxes. Discover short videos related to amazon flex uk taxes on TikTok. In the run up to Christmas youll be flat out.

Knowing your tax write offs can be a good way to keep that income in your pocket. Watch popular content from the following creators. Obviously I dont know what your income is so only you will know whether this is the case or not.

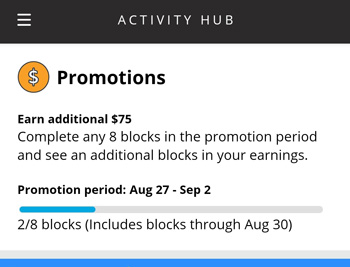

Once you calculate what that percentage is for the tax year divide that number by 4 -- and you have your quarterly estimated tax payments. A few basic hints and tips for registering as self employed sole trader and information on when and how to file your tax returnThis is rather a broad topi. Whilst the Amazon Flex app is impressive its not without its faults.

How Much To Put Away For Quarterly Taxes. According to a report in the Times Amazon which paid only 144m in corporation tax on total UK revenues of 137bn last year will not have to pay the tax on goods it sells. Vehicle requirements are the same across.

With Amazon Flex you work only when you want to. Single Life Empowerment Coachchantellethecoach Amazon FBA UKlazybosssimona homebodyHQ DIYs Home Hackshomebodyhq Laura Ripleylauraripley The Real CPAtherealcpa_ey AmazonFlexEOEamazonflexeoe. I am aware that being classed as self employed means I will need to fill.

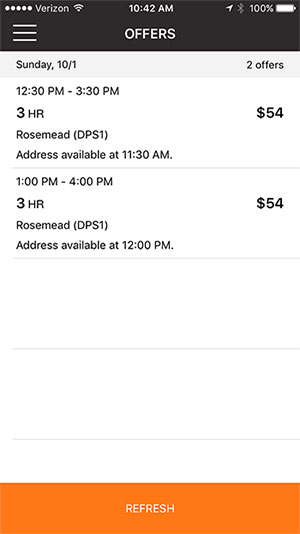

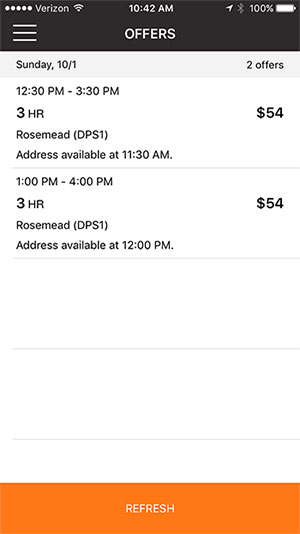

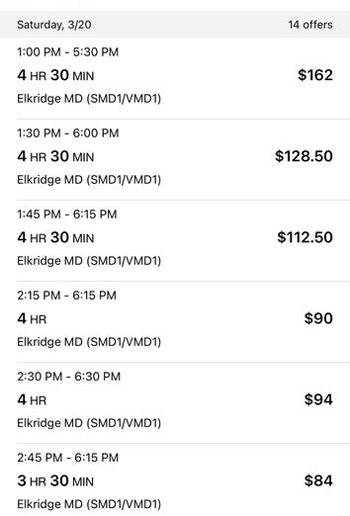

You can plan your week by reserving blocks in advance or picking them each day based on your availability. We would like to show you a description here but the site wont allow us. If you have a W-2 job and do Amazon Flex for extra money you can have more taxes withheld at your main job instead of paying quarterly taxes.

Watch popular content from the following creators. Heres how much you need to pay in estimated taxes. Hey fellow British Flex drivers.

You will need to report your business income to the IRS and pay any amount that is due. You end up running all day on empty stomach and it doesnt matter if is raining or not. Vehicles with fewer than 5 seats are not eligible to be used for deliveries with the exception of vans andor enclosed bed pickup trucks in order to protect parcels from weather.

The vehicle you use to deliver with Amazon Flex needs to be a mid-size or larger car with capacity of 5 seats or more. But if including your Flex income takes your OVERALL income full time job Flex over 50K for the year then youll be taxed at the higher rate - 40. This is the only thing I can think of as to why youre being asked to pay 3000 in tax.

Amazon Flex UK states on its website that drivers can make 13-15 per hour while driving for Amazon Flex but our research shows how this may not be the case. If Amazon selling is your main source of UK income youll be taxed on your profits each tax year in three ways. As a self-employed independent contractor you will have to pay taxes and self-employment tax on your business income.

Choose the blocks that fit your schedule then get back to living your life. Beyond just mileage or car expenses getting a 1099 from Amazon means that you can claim a lot of other expenses as tax write offs -- the phone you use to call residents with a locked gate the insurance and down payments on. If you dont have other tax withholding that covers your tax liability you will need to make quarterly tax payments.

Ad We know how valuable your time is. Income Tax depending on how much you earn youll be taxed at 20 40 or 45. You already know that its important to have auto insurance.

Get started now to reserve blocks in advance or pick them daily based on your schedule. Ive been doing Flex in Glasgow Motherwell and Glasgow depots for about a month now to compliment my full time 9-5 job and been researching about taxes. If you still cannot log into the Amazon Flex app please contact us at 888-281-6906 daily between 8 am.

Amazon Flex does not take out taxes. You will also have to pay unemployment tax on any income you make at your job.

How Much Would It Cost To Buy One Of Everything On Amazon

How To Get More Amazon Flex Blocks 6 Best Tips For Drivers

Happy Birthday Neon Sign Happy Birthday Banner Custom Neon Sign Party Sign Birthday Party Backdrop Pink Neon Sign Neon Custom Light

How To Get More Amazon Flex Blocks 6 Best Tips For Drivers

How To File Amazon Flex 1099 Taxes The Easy Way

Being An Amazon Flex Driver In 2022 Requirements Pay Work Overview Ridesharing Driver

Amazon Flex Deactivated Account Why And How To Reactivate

Being An Amazon Flex Driver In 2022 Requirements Pay Work Overview Ridesharing Driver

How To Get More Amazon Flex Blocks 6 Best Tips For Drivers

Being An Amazon Flex Driver In 2022 Requirements Pay Work Overview Ridesharing Driver

Being An Amazon Flex Driver In 2022 Requirements Pay Work Overview Ridesharing Driver

Amazon Flex 3 61 1 85 0 Download For Android Apk Free

How To File Amazon Flex 1099 Taxes The Easy Way

Being An Amazon Flex Driver In 2022 Requirements Pay Work Overview Ridesharing Driver

How To Get More Amazon Flex Blocks 6 Best Tips For Drivers

How To Get More Amazon Flex Blocks 6 Best Tips For Drivers

How To File Amazon Flex 1099 Taxes The Easy Way

Whether You Re A Courier For Postmates Amazon Flex Doordash Or Any Other Delivery Service Beauty Subscriptions Delivery Groceries Beauty Box Subscriptions

We All Love Flexible Job Opportunity And Amazon Flex Is A Great Option Amazon Flex Is Now Coming To Flexible Jobs Amazon Flex Jobs Money Making Opportunities